Plan Resources

Looking for information about CoOportunity Health Plans?

Use the tabs below to find learn more about working with us:

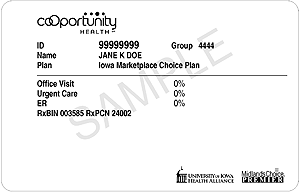

Plans – Includes plan descriptions, sample ID cards, and Advanced Premium Tax Credit explanation

IMCP – Provides information about our 2014 participation with the Iowa Marketplace Choice Plan

Features – Includes Three-for-Free description

Benefits – Provides additional coverage information

Self-Insured – Explains the differences between fully- and self-insured plans

Handouts – Describes a variety of topics through printable fact sheets

Visit our online CoOportunity Health Provider Manual for links to additional information including:

- Administrative Policies

- Medical Policy/Coverage Criteria

- Forms for Providers

- Claim Policies

- Prior Authorizations and Notifications

Products and Networks

CoOportunity Health members may be covered by one of these products:

- CoOportunity Premier – in Iowa and Nebraska

- CoOportunity CorePlus UI Health Alliance – in Iowa

- CoOportunity Preferred UI Health Alliance – in Iowa

- CoOportunity Choice UI Health Alliance – in Iowa

In addition, we:

- Contract with HealthPartners Administrators, Inc. to serve as a third-party administrator for self-insured employer-sponsored health plans (see Self-Insured tab).

- Covered adults from January 1, 2014 through November 30, 2014, who were eligible for Iowa’s Medicaid Expansion program, which is called the Iowa Marketplace Choice Plan. Please see the IMCP tab for more information.

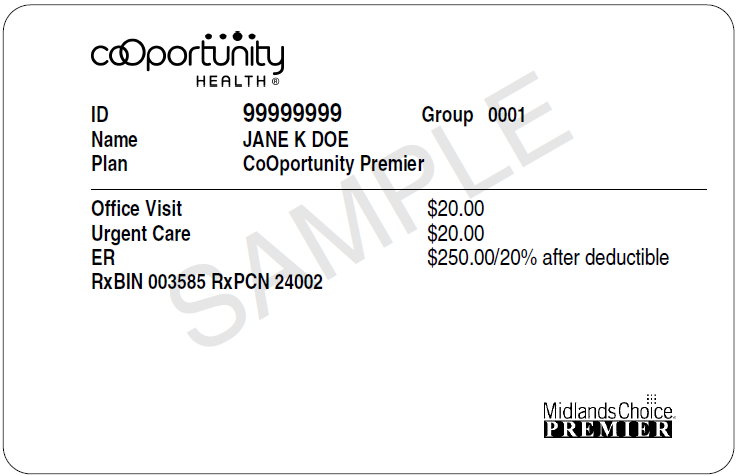

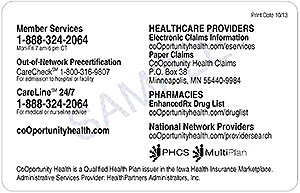

Important Note About ID Numbers: All members, regardless of age, receive an ID card with a unique ID number. These numbers are not necessarily sequential for all family members. Use your patient’s name and his or her number when filing a claim. To look up an ID number, log on to our secure Provider website and enter the patient’s birth date and name using the Eligibility tool.

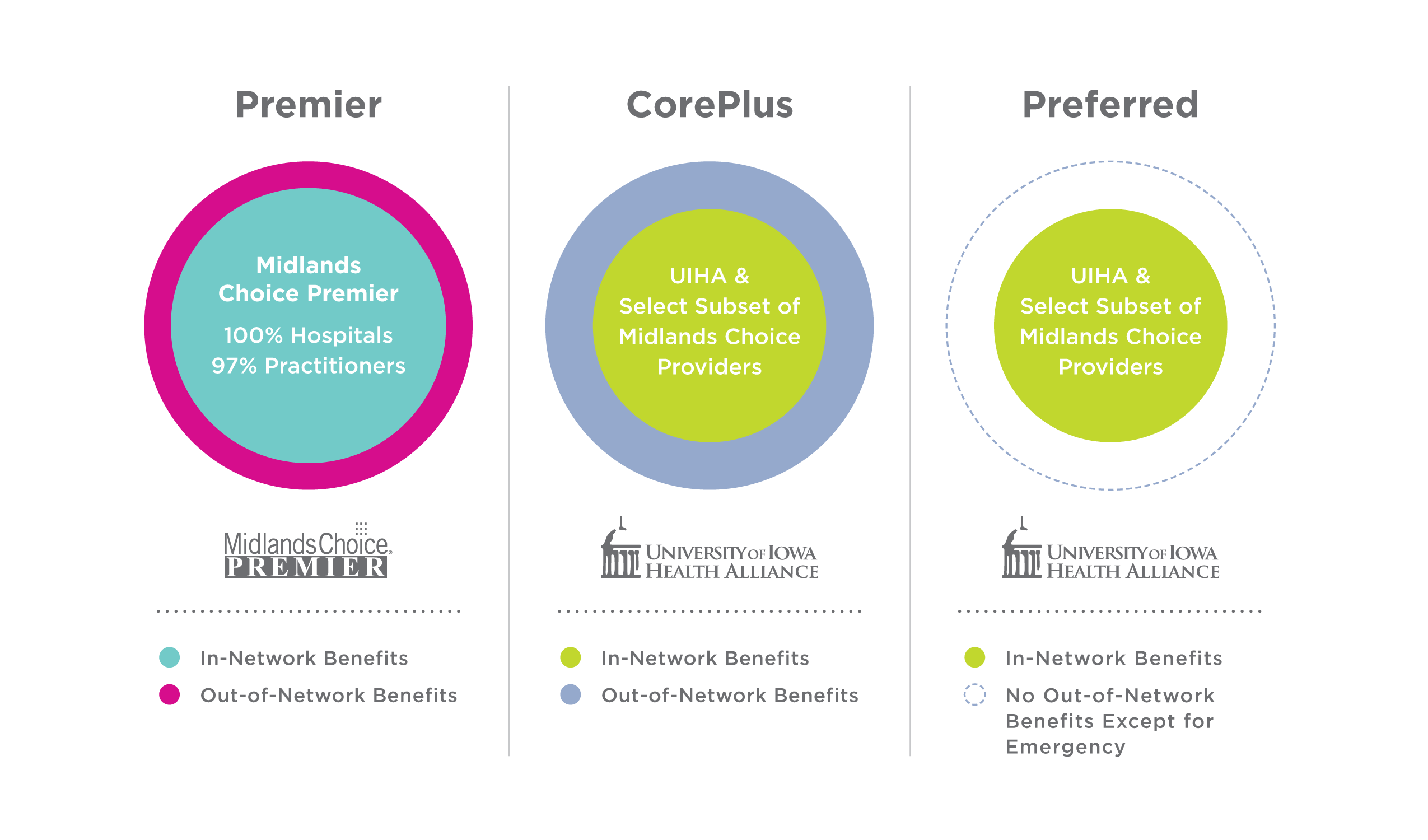

CoOportunity Premier – This preferred provider organization (PPO) product uses the Midlands Choice network of contracting providers. This product is available to residents of Iowa and Nebraska and businesses that are domiciled in Iowa and Nebraska.

CoOportunity CorePlus – This select network preferred provider organization (PPO) is available to residents in 64 Iowa counties. CorePlus includes in- and out-of-network benefits.

- In-network – A subset of Midlands Choice facilities and providers which includes the University of Iowa Health Alliance member organizations and other select providers.

- Out-of-network – Providers who are not part of the subset of Midlands Choice providers described above.

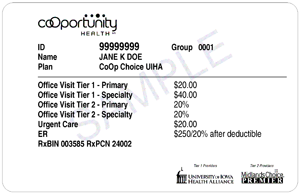

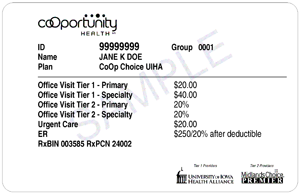

CoOportunity Choice UI Health Alliance – This open access three-tier product is available in Iowa only.

- Tier 1 consists of a subset of Midlands Choice facilities and providers which includes the the University of Iowa Health Alliance and other select providers. This is the same subset of Midlands Choice providers designated as in-network for CorePlus and Preferred in 2015.

- Tier 2 includes Midlands Choice providers who are not a part of the Tier 1 subset described above. Members have higher out-of-pocket costs when receiving care from Tier 2 providers.

- Tier 3 includes providers who are not contracted with Midlands Choice. Members have the highest out-of-pocket costs for Tier 3 provider services.

For a printable handout containing a summary of the above, see A Brief Overview of Our 2015 Products.

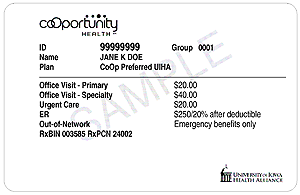

CoOportunity Preferred UI Health Alliance – This exclusive provider organization (EPO) product is available in 64 Iowa counties and does not provide benefits outside of the Preferred network except for necessary emergency care.

- In-network – A subset of Midlands Choice facilities and providers which includes the University of Iowa Health Alliance member organizations and other select providers. This is the same 2015 network being used by CorePlus.

- Out-of-network – Providers who are not part of the subset of Midlands Choice providers described above.

Away From Home Care

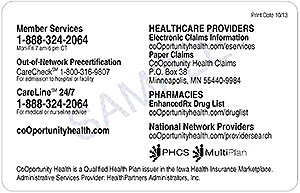

Our national provider networks – PHCS Network and MultiPlan network – allow members to receive care from in-network providers when outside of Iowa, Nebraska and South Dakota. These national networks are applicable to Premier and Choice (Tier 2).

Provider Directories

Help members reduce costs by using or referring them to in-network providers.

Our products have separate, higher cost shares for out-of-network services. In addition, out-of-network providers may balance bill for any difference between the billed charge and the allowed amount.

To locate an in-network provider in Iowa, Nebraska, or South Dakota:

- Visit provider search.

- Select your patient’s product name.

- Select one of the links listed in the Local Providers search tool (Doctor, Clinic/Hospital, Pharmacy).

Read about contracting and credentialing.

Plan Level – The Metals

Within each of the basic products, CoOportunity Health offers plan levels or “metal levels.” In general, these levels provide members with choice when it comes to selecting a plan based on premiums and out-of-pocket costs for services.

Metal levels are not identified on the ID card. However, each ID card identifies member in-network copayment amounts; specific benefit information is available using our secure Eligibility tool.

- Catastrophic – Offers the highest member out-of-pocket costs; available to consumers younger than 30 years old.

- Bronze – Offers cost-share amounts that are similar to the catastrophic metal level.

- Silver – Offers lower member cost shares.

- Gold – Offers individuals and small groups in Iowa the lowest member cost shares.

- Platinum – Offers small groups in Nebraska the lowest member cost shares.

All member cost-share amounts—copayments, deductibles, and coinsurance—are part of a member’s out-of-pocket maximum. This includes copayments for medical and pharmacy services. Remember, CoOportunity Health plans have a separate deductible and out-of-pocket maximum for in- vs. out-of-network services.

Health Savings Accounts (HSAs)

CoOportunity Health products include a qualified high-deductible option that works in combination with a health savings account (HSA). Individuals can make yearly tax-free contributions into an HSA account.

Bronze, silver, and gold HSA plans are available.

No service is paid—including drugs and office visits—until the deductible is met. Exception: Routine preventive care from an in-network provider is covered at 100 percent and is not subject to any member cost share amounts.

Our HSA plans use aggregate medical deductibles and out-of-pocket maximums. This means that if the member has a family plan:

- Claim reimbursements do not begin for any one family member until the family deductible is met.

- Services are not covered in full for any one family member until the family out-of-pocket maximum is met.

Advanced Premium Tax Credit

Memberswho receive an advanced premium tax credit(APTC) to help with their healthcare premiums are eligible for a grace period of up to three months to pay their premium. These members are the only CoOportunity Health members eligible to receive a three-month grace period, and qualify for this grace period as long as they have paid a minimum of one month’s premium.

Members who do not receive APTC receive a 31-day grace period.

For details, please review our Advanced Premium Tax Credit Fact Sheet.

November 30, 2014, is the last day that CoOportunity Health provided coverage to members who have the Iowa Marketplace Choice Plan—one component of Iowa’s Medicaid Expansion program (see ID card below). We have worked collaboratively with the Iowa Department of Human Services (DHS) and Iowa Medicaid Enterprise (IME) to ensure a seamless transition of these individuals to the Iowa Wellness Plan effective December 1, 2014.

Please ask these patients for new insurance information beginning December 1, or call Iowa Medicaid Enterprise (IME) member eligibility verification system (ELVS) at 1.800.338.7752 or 1.515.323.9639 for information.

Professional and outpatient claims will process based on coverage in place on the date of service. Facility inpatient claims will process based on the admission date.

We encourage you to file CoOportunity Health claims for IMCP members by March 1, 2015.

Unique Feature

CoOportunity Health plans offer a unique feature not required by the Affordable Care Act.

- Three-for-Free – Some members have a Three-for-Free benefit. This benefit waives each covered person’s office visit copayment for three nonpreventive office calls each calendar year. Things to know:

- Office visits submitted by in-network primary or specialty care providers and/or outpatient behavioral health providers are eligible. For members covered by our Choice plan, the services must be from a Tier 1 provider.

- The benefit applies only to the first three office visit CPT® codes processed by CoOportunity Health.

- Other services provided during the visit, such as laboratory services, are subject to applicable deductibles or other cost-share amounts.

- Our contracts cover routine preventive services without a member cost-share amount; therefore, a preventive office visit is not included in the Three-for-Free.

- The secure Provider website does not identify whether a covered person has exhausted this benefit or not. To find out if we have processed claims that have exhausted a member's Three-for-Free benefit, contact Member Services at 1.888.324.2064.

For information about CoOportunity Health’s coverage requirements, see Prior Authorizations and Notifications.

Essential Health Benefits

In addition to requiring coverage with no lifetime and no annual dollar limits, the Affordable Care Act requires coverage of ten categories of essential health benefits in all individual and small group plans:

- Emergency services

- Hospitalization

- Maternity and Newborn Care

- Mental Health and Substance Use Disorder Services

- Prescription Drugs

- Rehabilitative and Habilitative Services and Devices

- Laboratory Services

- Routine preventive and Wellness Services, Chronic Disease Management

- Pediatric Dental and Vision Care*

- Ambulatory Patient Services

*CoOportunity Health plans do not include pediatric dental benefits. Dental coverage is available on the Iowa and Nebraska Health Insurance Marketplace and can be purchased as a stand-alone coverage.

Routine Preventive Care

CoOportunity Health covers routine preventive care for all of our members.

When provided by an in-network provider, CoOportunity Health covers services billed as routine preventive care at 100 percent of the allowed amount; they are not subject to deductibles or other member cost-share amounts.

To locate payable routine preventive services, check our Preventive Care fact sheet or visit our medical policies:

Routine preventive services do not include those intended to treat an existing illness, injury, or condition, or one discovered during a preventive exam. However, this does not preclude patients who present with an illness or who have a chronic disease from receiving routine preventive services. See our Claims Manual for information.

CoOportunity Health has adopted guidelines recommended by the Institute of Clinical Systems Improvement (ICSI), the Centers for Disease Control (CDC), and the guidelines of the U.S. Preventive Services Task Force for use in administering our health plans.

Self-Insured Employer-Sponsored Plans

To identify a member of an employer-sponsored plan, look at patient ID cards. These ID cards are:

- Are branded with the HealthPartners Administrators, Inc. (HPAI) logo.

- May also include the employer’s logo.

- Include HealthPartners information on the back of the ID card.

Website Resources

Use the URLs below to locate specific resources for self-insured members. Some of these resources are found on the back of an identification card.

To access specific member eligibility and benefit information or a self-insured patient’s remittance, register for access to the HealthPartners secure Provider website at healthpartners.com/provider.

- Administrative Policies:healthpartners.com/hpiaadministrativepolicies

- Medical Policies/Coverage Criteria: healthpartners.com/policies

- Website/Register for Secure Access: healthpartners.com/provider

- Drug Formulary: healthpartners.com/formulary

- EFT Registration: healthpartners.com/eft

- EDI/Electronic Connectivity: healthpartners.com/provider-public/edi

For more information about the self-insured and fully-insured plans, review the information in our Differences Affect Your Workflow Fact Sheet or contact HealthPartners using information identified above..

Read or print the following Fact Sheets to share with your staff.